AstraZeneca (AZN) Technical Market Insight

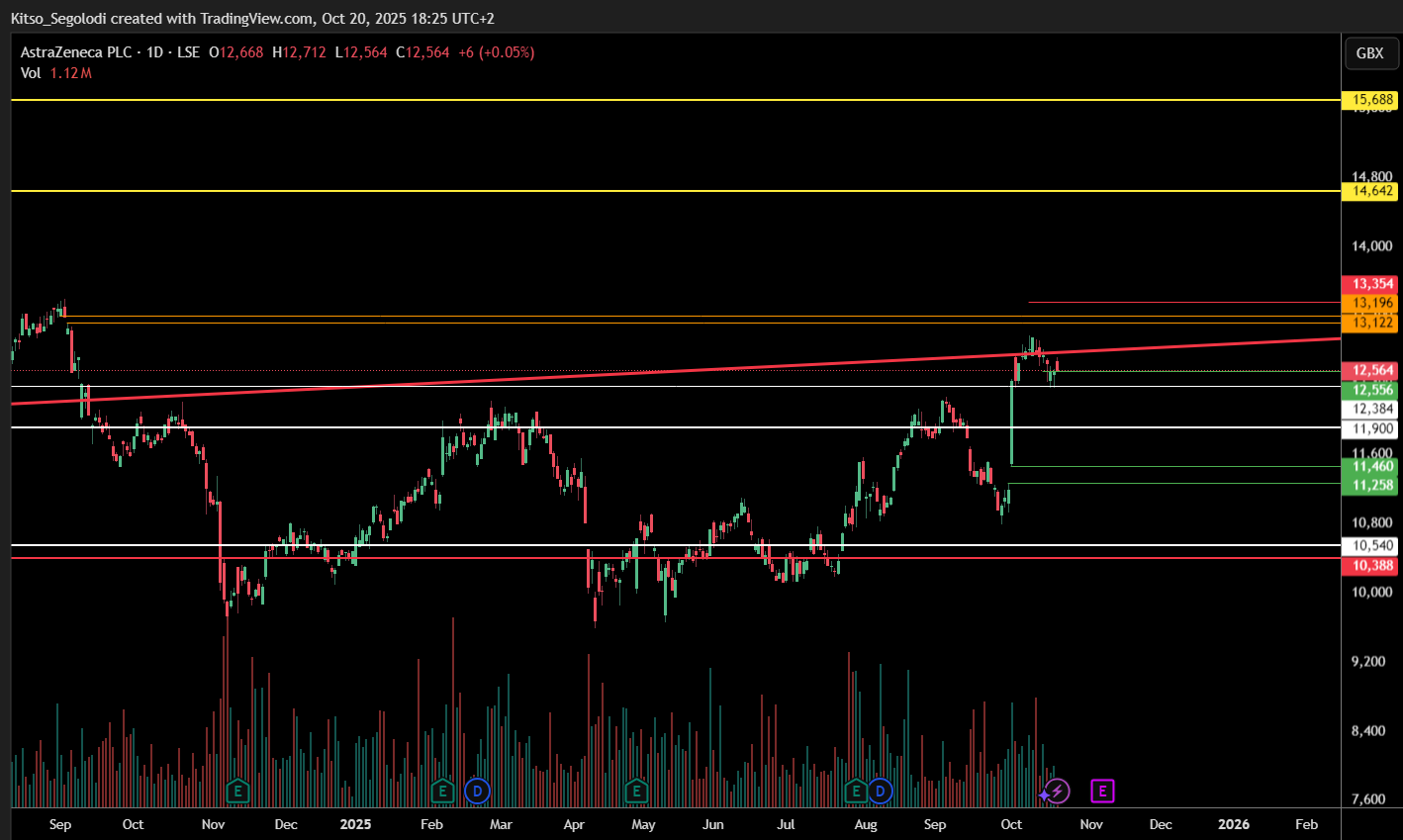

AstraZeneca PLC (AZN) is currently trading at a key resistance area, with price consolidating around GBX 12,564 / GBX 12,556. This zone offers an attractive buy opportunity for short-term traders targeting a potential rebound toward the GBX 13,122 / GBX 13,196 level — aligning with the gap-down observed on September 4, 2025.

The next significant resistance zone stands at GBX 13,354, which could act as a profit-taking level before a possible retest or continuation higher.

Should downward pressure persist, a correction toward GBX 11,900 would represent a healthy retracement and potential accumulation point. A deeper dip toward the GBX 11,258 / GBX 11,460 gap-up zone would further strengthen long-term buying prospects.

From a broader technical perspective, long-term price targets remain at GBX 14,642 and GBX 15,688, contingent on market sentiment, sector strength, and upcoming earnings performance.

Outlook:

- Short-Term: Bullish bias while holding above GBX 12,384 support.

- Medium-Term: Watch for a breakout above GBX 13,354 to confirm continuation.

- Long-Term: Positive structure; potential for sustained recovery toward 2024 highs.