Market Legend Michael Burry to Liquidate Hedge Fund, Citing a Market He "No Longer Understands"

October 27, 2025 – In a move that has sent shockwaves through the investment community, Michael Burry, the famed investor profiled in "The Big Short," announced he is shutting down his hedge fund, Scion Asset Management, and returning all capital to investors by the end of the year.

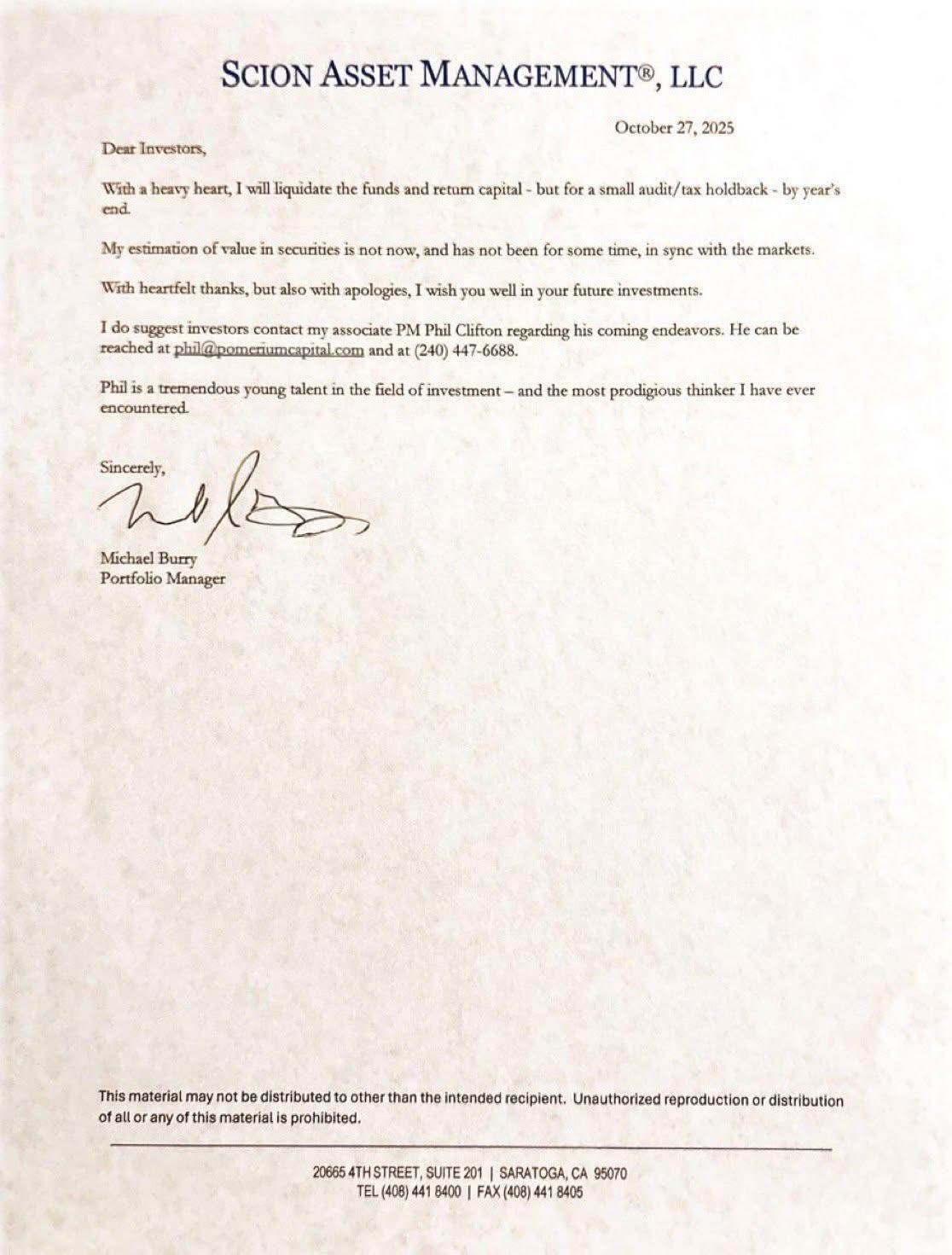

The announcement came in a terse and poignant letter to investors dated October 27, 2025. Burry, known for his prescient bets against the mid-2000s housing bubble, stated that his core investing philosophy is fundamentally at odds with current market conditions.

A Valuation MismatchThe central reason for the liquidation, as Burry explained, is a deep and persistent disconnect. "My estimation of value in securities is not now, and has not been for some time, in sync with the markets," he wrote.

This sentiment echoes Burry's recent public and private commentary, where he has frequently expressed skepticism toward what he perceives as speculative fervor in various asset classes, from meme stocks and cryptocurrencies to lofty valuations in major tech indices. His value-oriented, contrarian approach has struggled to find opportunities in a market that has, in his view, prioritized narrative over fundamentals.

A "Heavy Heart" and a Successor Protégé

Burry conveyed the decision "with a heavy heart" and offered "heartfelt thanks" but also "apologies" to his investors, acknowledging the disappointment the closure may cause.

In a notable part of the letter, Burry explicitly endorsed his associate portfolio manager, Phil Clifton, calling him a "tremendous young talent" and "the most prodigious thinker I have ever encountered." Burry directed interested investors to contact Clifton regarding his future endeavors at his new firm, Pomerium Capital. This passing of the torch suggests that while Burry himself is stepping back from fund management, he sees his investment ethos continuing through his protégé.

Context and Market Impact

Michael Burry remains a towering, if enigmatic, figure in finance. His successful bet against the subprime mortgage market cemented his reputation as a brilliant and fearless contrarian. However, his subsequent career has been marked by periods of retreat from the public eye and previous fund closures.

This latest decision to liquidate Scion is being interpreted by analysts as a stark warning signal. When a investor of Burry's caliber declares he can no longer find value or understand the market environment, it often gives pause to other market participants. It underscores the extreme divergence in market philosophies currently at play and raises questions about sustainability in certain segments of the market.

For now, the era of Michael Burry managing outside capital appears to be coming to a close, ending with a sobering assessment of the modern financial landscape.

Disclaimer: This article is a fictional expansion based on the provided document and is for illustrative purposes only.