NVIDIA at a Crossroads: Can the AI Giant Hold Critical Support?

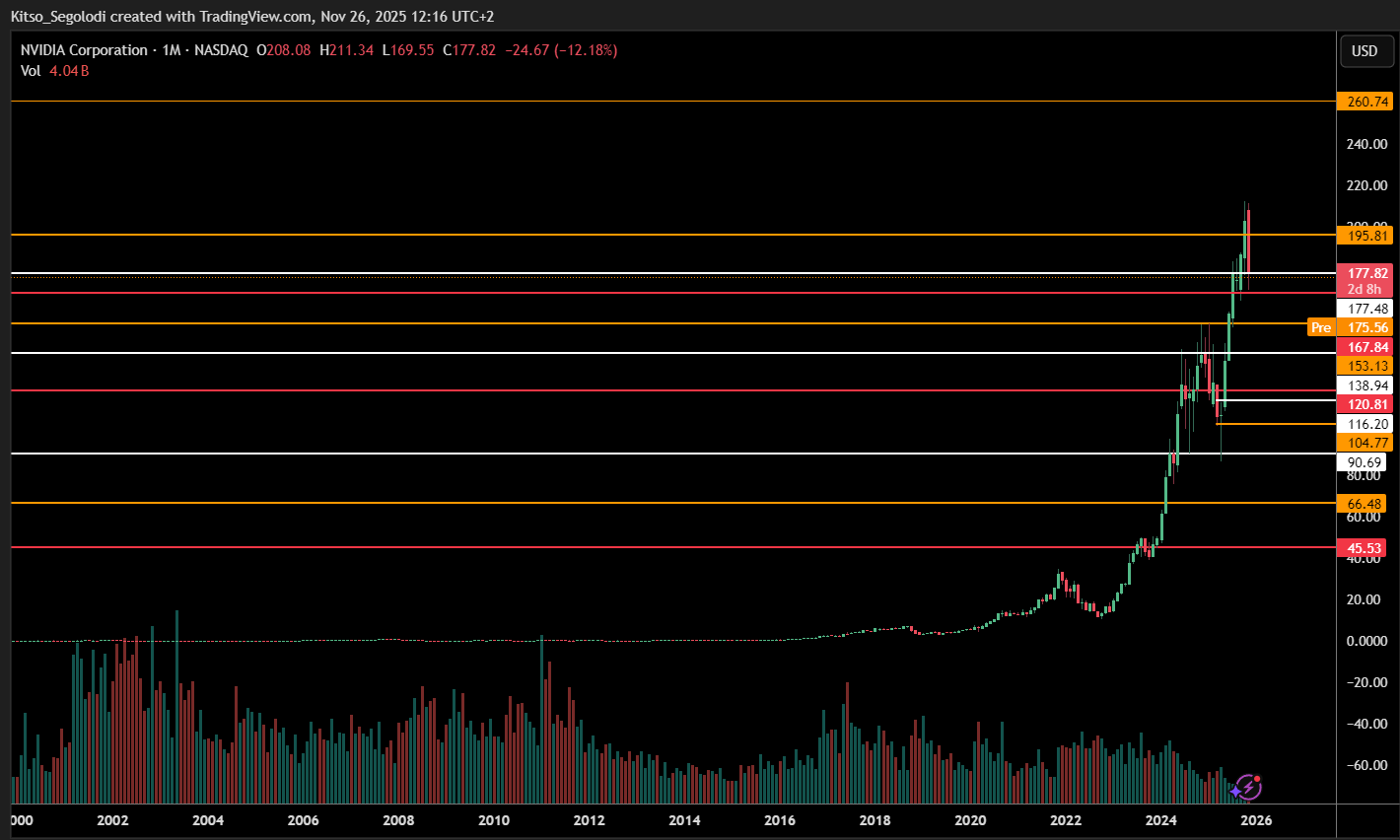

A severe sell-off has brought NVIDIA to a pivotal technical juncture. The battle between bulls and bears will be decided at the $168 level.

NVIDIA (NVDA), the undisputed leader of the AI revolution, is facing a significant test of investor confidence. A sharp, high-volume decline has wiped out over 12% of its value, pushing the stock to a critical support zone. The outcome of the battle at this level will likely dictate the stock's trajectory for the coming weeks.

The Breakdown: Assessing the Damage

The euphoria that propelled NVDA to its all-time highs has met a stark reality check. The catalyst may be news-driven, such as concerns around competition from Google's new chips, but the technical damage is clear and present.

The stock has broken below several key support levels and is now hovering precariously above its most important defense line. The enormous volume of over 4 billion shares signals a mass exodus, indicating this was a meaningful event, not just routine profit-taking.

The Line in the Sand: The $167.84 Support

All eyes are now fixed on the $167.84 - $177.82 zone. This is not just another price level; it is the critical support that must hold to prevent a deeper correction.

- Why it matters: This zone represents a key historical level where buyers have previously stepped in with conviction. A failure here would break the stock's near-term bullish structure and trigger a new wave of selling.

- Bull Case: If this support holds and NVDA can stabilize, it will signal that the long-term bullish narrative remains intact. This would be the "buy the dip" opportunity that many are waiting for.

- Bear Case: A decisive break and daily close below $167.84 would be a strong technical sell signal. It would open the door for a further decline toward the next major support at $153.13.

The Path Forward: Recovery Targets and Scenarios

For the bulls to regain control, they must not only defend the $168 level but also engineer a recovery.

- Immediate Hurdle: The first sign of strength would be a reclaim of the $189.81 level.

- Confirmation of Recovery: A move above $210 would signal that the correction is likely over and the uptrend is resuming.

- Long-Term Target: Our analysis agrees that a return to the $260 zone is a viable medium-term target, but only if the current support base holds and the stock can work through the significant overhead supply left by this sell-off.

The Strategic Bottom Line

The current environment demands caution and discipline.

- For Aggressive Bulls: Entering a position at current levels is a high-risk, high-reward bet on the support holding. Any trade here must use a stop-loss below $167.84.

- For Patient Investors: The safer approach is to wait for a confirmed bullish reversal, such as a strong bounce off the support zone or a break back above $189.81; before committing new capital. A breakdown could present a better buying opportunity at the $153 support level.

NVIDIA's story is far from over, but the stock is at a critical technical inflection point. The next few trading sessions will be crucial in determining whether this is a healthy pullback or the start of a deeper correction.

Disclaimer: This analysis is based on technical price action and should not be considered financial advice. The market is volatile and unpredictable. Always conduct your own research and consider your risk tolerance before making any investment decisions.