Occidental Petroleum (OXY) – Strategic Pullback or Setup for a Surge?

Occidental Petroleum Corporation (NYSE: OXY) is trading at $44.85, reflecting what appears to be a healthy profit-taking phase after recent rallies. But beneath the surface, the chart and fundamentals suggest a potential setup for bullish continuation — especially for investors seeking exposure to energy-backed assets with institutional momentum.

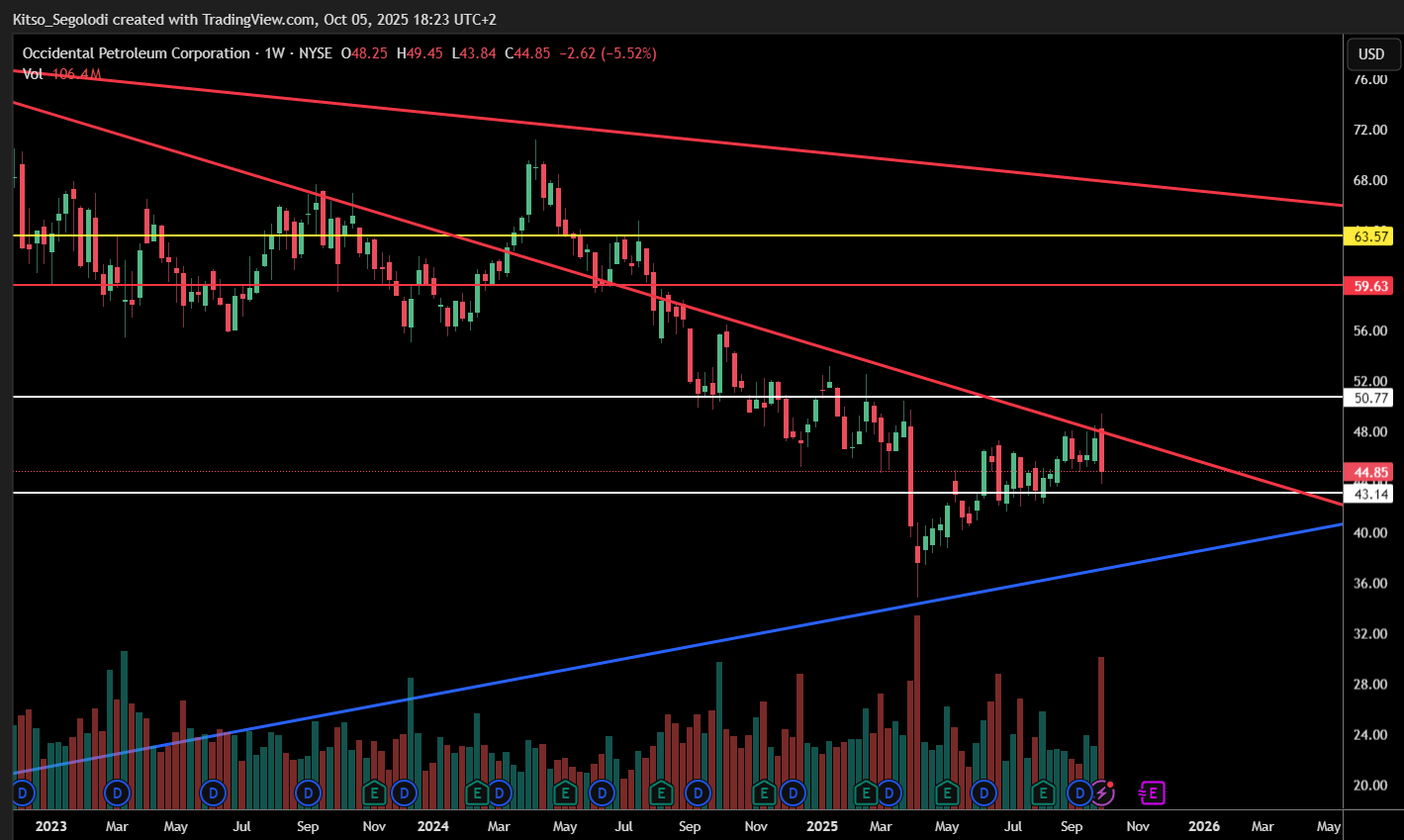

Technical Breakdown

- Current Price: $44.85

- Buy Zone: $43.14 – tactical entry on pullback

- Near-Term Target: $50.77

- Medium-Term Target: $59.63

- Long-Term Target: $63.57

- Trend Structure: Bullish bias remains intact above the blue ascending trendline

The weekly chart shows price action respecting long-term support, with volume tapering off — a classic sign of consolidation before potential breakout. As long as price holds above the blue trendline, the bullish thesis remains valid.

Fundamental Drivers

Bullish Catalysts

- Berkshire Hathaway’s $9.7B OxyChem Deal:

Occidental is divesting its chemical division to focus on core oil and gas operations. The deal enables repayment of $6.5B in long-term debt, improving balance sheet strength and capital allocation. - Strong Revenue Base:

Trailing twelve-month revenue stands at $27.15B, with net income of $1.73B and a market cap of $44.15B — signaling resilience amid sector volatility. - Dividend Stability:

With a 2.14% yield, OXY remains attractive for income-focused investors, especially in inflationary environments. - Analyst Sentiment:

Consensus price targets range from $50.95 to $54.32, with upside potential of 13–20% from current levels. Some analysts project targets as high as $75.00.

Risks to Watch

- Sector Volatility:

Oil prices remain sensitive to geopolitical shifts and OPEC+ decisions. Any sharp downturn could pressure margins. - Earnings Uncertainty:

Upcoming earnings (Nov 11, 2025) will be critical in confirming operational strength post-divestiture. - Hold Ratings Dominant:

Out of 22 analysts, 17 rate OXY as “Hold,” suggesting cautious optimism rather than aggressive accumulation.

Legacy Ladder Perspective

Occidental Petroleum offers a strategic accumulation opportunity for clients seeking:

- Energy sector exposure with institutional backing

- Dividend yield and debt reduction narrative

- Tactical entry zones for medium-term growth

We remain bullish, with a preference for accumulation near $43.14, and confirmation of breakout strength above $50.77. A sustained move toward $59.63–$63.57 aligns with sector rotation, debt restructuring, and post-divestiture focus.