Palantir (PLTR) – At the Crossroads of Momentum and Valuation

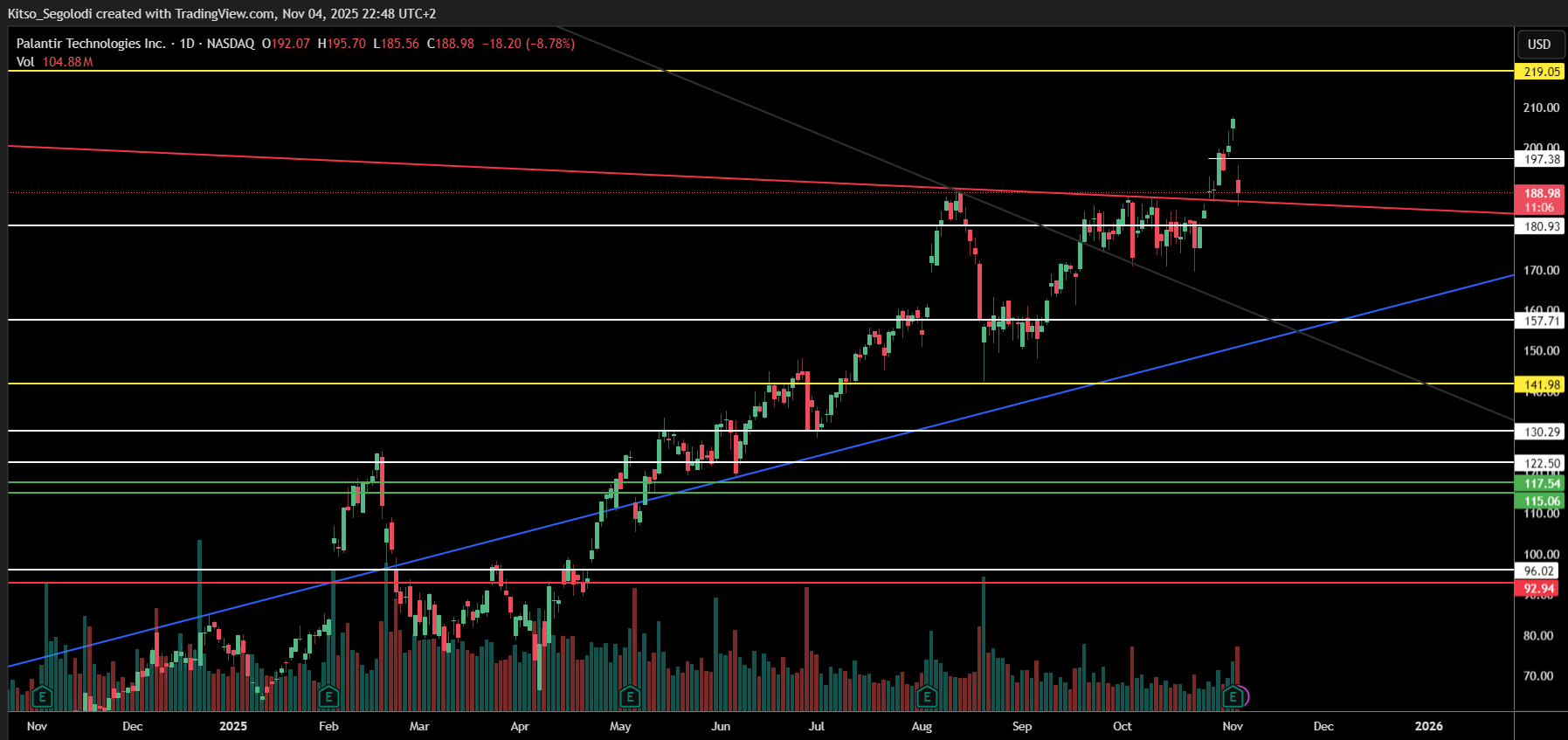

Palantir Technologies Inc. (NASDAQ: PLTR) is trading near a critical support/resistance zone, defined by a long-standing red descending trendline. With price action hovering around $188–$190, the next few candles could determine whether bulls regain control or if valuation concerns trigger deeper consolidation.

Technical Outlook

- Current Price Zone: ~$188.85

- Breakout Trigger: A close above $197.38 could unlock momentum toward $219.00

- DCA Opportunity: If price pulls back to $180.93, it presents a tactical entry for dollar-cost averaging

- Deeper Buy Zone: $157.71 – where bulls may re-enter with conviction

- Bearish Risk Level: A close below $157.71 could expose $141.98, though this remains a lower-probability scenario

- Trend Structure: Bullish bias remains intact above the blue ascending trendline

This setup offers both short-term tactical entries and medium-term breakout potential, especially for investors who understand the volatility of AI-driven valuations.

Market Sentiment & Fundamentals

Bullish Catalysts

- Wedbush Raises Target to $230: Analysts cite explosive demand for Palantir’s AI platform and government contracts

- Q3 Revenue Surge: $1.18B in Q3, up 63% YoY, beating consensus estimates

- Commercial Business Growth: U.S. commercial segment jumped 121% YoY, with RPOs up 66% to $2.6B

Bearish Pressure

- Valuation Concerns: RBC Capital warns of a potential 76% crash, citing unsustainable EV/revenue multiples

- Michael Burry’s $912M Put Position: Signals institutional skepticism despite strong earnings

- Post-Earnings Selloff: Despite beating estimates, PLTR dropped 8% in premarket trading — a sign of profit-taking and valuation anxiety

Legacy Ladder Perspective

Palantir presents a high-risk, high-reward equity play for investors who:

- Understand the volatility of AI and SaaS valuations

- Are prepared to DCA during pullbacks

- Can hold through short-term noise for long-term upside

We remain cautiously bullish, with tactical interest at $180.93, deeper accumulation at $157.71, and confirmation of breakout strength above $197.38. The $219.00 target remains valid if momentum resumes and valuation concerns ease.