The 2026 Inflection Point: Why Commodities Are Primed for a Historic Move

As structural imbalances collide with policy shifts, a new commodity supercycle may be emerging. Here’s where the value lies.

For years, commodities have been the neglected stepchild of the financial markets, overshadowed by the relentless rally in tech stocks and passive indices. But beneath the surface, powerful forces have been building. Now, a convergence of factors; from untenable fiscal paths and supply constraints to an inevitable pivot in monetary policy; suggests we are approaching a major inflection point, potentially as soon as 2026.

Gold has already broken the ice, signaling a loss of confidence in fiat currency debasement and rising geopolitical tensions. But this is likely just the opening act. What follows could be a much broader, more powerful move across the entire resource complex.

The core driver? An unavoidable ultra-dovish Federal Reserve. The battle between restraining inflation and servicing unprecedented debt loads is nearing its end. The structural imbalances; decades of underinvestment in supply chains, energy infrastructure, and critical mining; have created a powder keg. When the Fed ultimately chooses to accommodate these realities with lower rates, even amid sticky inflation, the stage will be set for a historic re-pricing of hard assets.

For investors with a multi-year horizon, this presents a extraordinary opportunity. Let’s explore the most compelling and potentially undervalued sectors.

1. The Precious Metals Reset: Silver’s Time to Shine

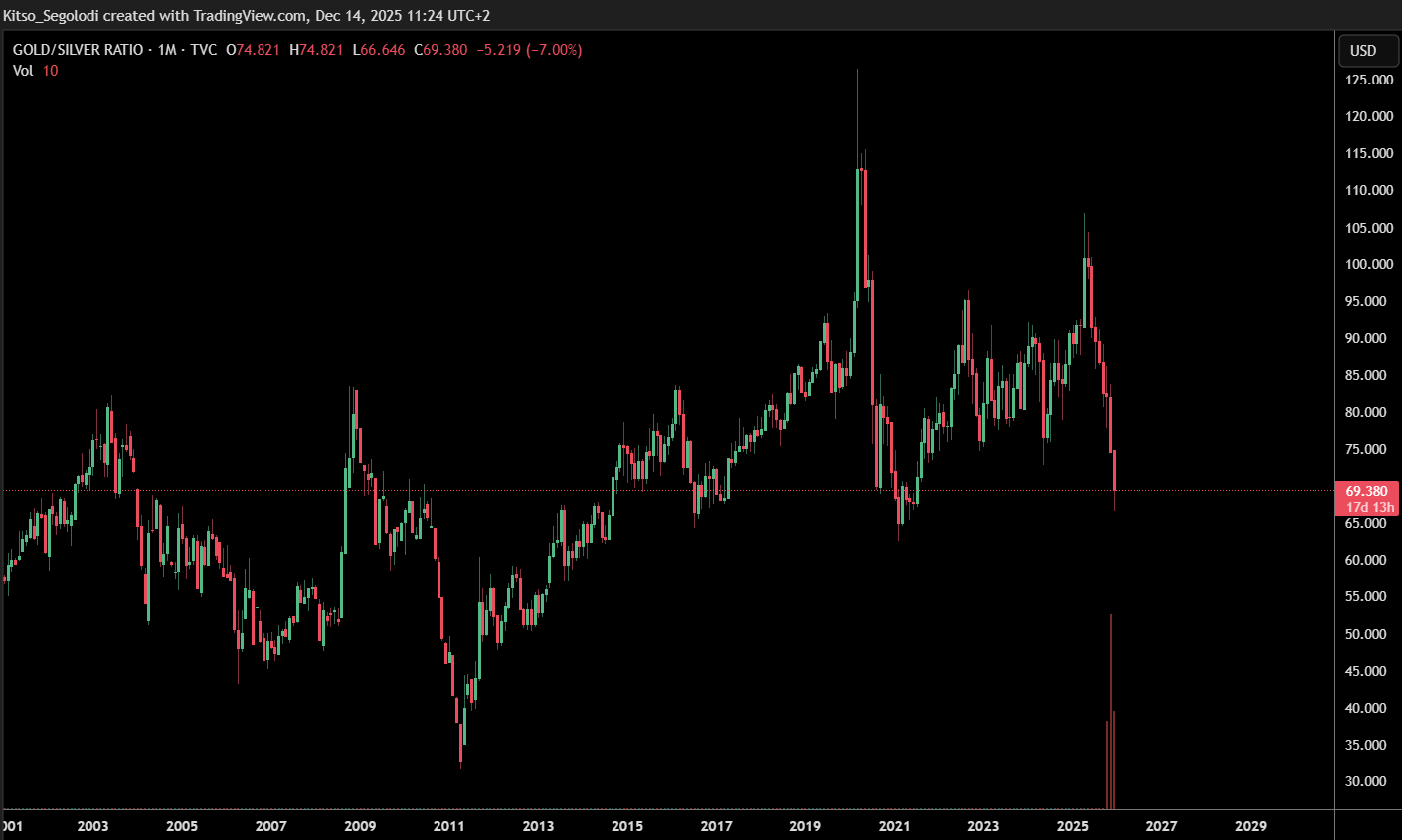

While gold rightly gets attention as a monetary hedge, its often-overlooked sibling, silver, holds explosive potential. The key metric is the gold-to-silver ratio, historically around 60:1 but currently elevated in the 80s. This ratio almost always contracts violently during true precious metal bull markets.

Why silver now? It possesses a dual identity. As gold rallies, silver attracts monetary demand. But its real leverage comes from its irreplaceable industrial role. It is a critical component in solar panels, electronics, and the broader electrification megatrend. As green infrastructure spending accelerates globally, silver’s demand floor rises dramatically. A move back toward the historical ratio implies significant upside from current levels, making it one of the most undervalued stories in the space.

2. Copper: The indispensable Metal Enters Price Discovery

If one commodity encapsulates the tension between the past and the future, it’s copper. It’s the electricity metal, and the world is embarking on the largest electrification project in history; from electric vehicles (using 4x more copper than conventional cars) to AI data centers and renewed grid infrastructure.

Yet, supply is constrained. Major new discoveries are rare, and the lead time to develop a new mine can exceed a decade. Environmental and political hurdles add to the cost. Current prices, while strong, are likely below the incentive price needed to justify the massive capital required for new supply. We are approaching a true price-discovery phase, where the market realizes that to meet projected demand, prices must rise high enough to crush marginal demand. This isn’t a cyclical play; it’s a secular story with decades to run.

3. The Energy Comeback: Look Beyond the Barrel

The energy narrative is shifting. While oil may see a resurgence due to chronic underinvestment, the more structurally fascinating play is uranium. Its market is defined by a simple, inescapable math: a multi-decade supply deficit. Utilities are signing long-term contracts to secure supply for existing and new nuclear reactors, as nations from the U.S. to Europe to Asia recommit to nuclear for reliable, carbon-free baseload power. Inventories are being drawn down. This is a physical market squeeze playing out in slow motion, largely insulated from short-term economic cycles.

4. The Contrarian Play: Platinum’s Asymmetric Bet

For true contrarians, platinum presents a fascinating deep-value opportunity. Depressed by its association with diesel engines, its price languishes below gold. Yet, it is rarer and faces its own supply constraints from South Africa. The future demand driver lies in the hydrogen economy; platinum is a critical catalyst for hydrogen electrolyzers and fuel cells. As this technology gains traction, platinum could see a surge in demand just as supply remains challenged. It’s a call option on a key energy transition technology at a bargain price.

Navigating the Inflection: A Strategic Approach

This isn’t about chasing daily fluctuations. It’s about making a strategic allocation to real assets before the crowd recognizes the shift.

- Diversify Within the Theme: Consider broad-based commodity ETFs (e.g., GSG, DBC) alongside targeted exposure to the high-conviction ideas above.

- Choose Your Vehicle: Physical ETFs (like PSLV for silver) capture the metal move. Miner equities (copper, uranium producers) offer operational leverage but carry company-specific risks. Select high-quality, well-managed names.

- Mind the Timeline: The 2026 inflection point is a framework, not a precise date. Accumulate positions during periods of market pessimism and be prepared for volatility. This is a long-term portfolio hedge and growth opportunity rolled into one.

The Bottom Line:

We stand at the intersection of monetary folly and physical reality. The Fed’s coming dovish turn will not solve the deep-seated shortages in energy, metals, and food systems; it will simply reveal them by weakening the paper currency in which they are priced. For investors, this represents a clarion call to re-allocate to undervalued, real assets.

The seeds of the next commodity boom were sown in the underinvestment of the last decade. By 2026, we may well see them break into full bloom.

Disclaimer: This article represents a macroeconomic commentary and is not personal financial advice. The commodities markets are volatile. Always conduct your own due diligence and consider consulting with a qualified financial advisor before making any investment decisions.